‘All money is the matter of belief’- Adam Smith

Money is a medium that we use to meet our needs, buy goods or services or pay the salaries of employees. Considering the number of transactions today, it would be impossible to carry out these exchanges without a medium as effective and practical as money.

History of Money:

- Barter System (Trading Goods)

Before the invention of money, people used to make their transactions by bartering, in other words, exchanging the goods they possessed. However, making transactions in this way had some difficulties. There needs to be a 'double coincidence of wants'. For barter to occur between two parties, both parties need to have what the other wants. To make an exchange. There had to be someone who had the product or service demanded, and he or she had to be willing to exchange it for another product or service. For example, someone who had more apples than he needed and who wanted to cross the river had to find someone who had a rowboat and who was willing to offer this service in exchange for some apples.

- Commodity Money (Money with Value Itself)

To overcome such difficulties, people started using metals, animals, seashells, salt, weapons, whose value is accepted by all as a medium of exchange, although their value often had to be negotiated. This trading system spread worldwide and still exists in certain parts of the world today.

- Metal Coins

Over time, precious metals like gold and silver began to be used in trade. The Lydians (Lydia was an Iron Age kingdom located in western Asia Minor, now called Turkey. The people living in this kingdom were known as the Lydians, and their language was called Lydian. Sardis served as the capital of Lydia, which existed from around 1200 BC to 546 BC) were the first civilization to mint coins from these valuable metals in about 600BC. They were made of Electrum, a naturally occurring alloy of gold and silver and made King Croesus extremely wealthy. Today, people still use the phrase 'Rich as Croesus.'

As trade expanded, the demand for larger sums of money grew because it became challenging to conduct high-volume transactions with just coins, along with carrying heavy coins and posed a risk of theft. This led to the emergence of a new payment instrument in the 17th century.

- Paper Money

The Chinese were the first to use paper money in 1279, under the rule of the Mongol Emperor Kublai Khan (the grandson of Genghis Khan). He introduced the world’s first paper currency, made from tree bark, and told the people, “Leave your gold with us, and we’ll keep it safe. In return, you’ll receive a piece of paper stating how much gold you own.” Although people wanted a simpler way to trade, many were reluctant to exchange valuable gems, gold, or silver coins for just a piece of paper.

|

| Kublai Khan |

In the end, people accepted the system out of fear of Kublai Khan. These paper notes were called IOUs, meaning "I owe you," which allowed people to get their gold back whenever they wanted. Because the paper was much lighter than carrying heavy coins, it soon became a popular way to pay. More people began storing their gold with gold merchants, leading to the creation of the first banks. International trade expanded, and people started using these receipts, trusting that their gold was safe. However, as banks issued more IOUs than the gold they actually had, and with the rise of counterfeit IOUs, the market faced inflation. When people realized their IOUs were losing value, they rushed to the banks to reclaim their gold, but the banks couldn’t return all the gold. This caused widespread distrust in both banks and paper money.

- Gold standard paper money

In 1816, the UK passed a law called the gold standard, which stated that they would only print as much paper money as they had gold to back it. This helped control inflation and set limits on debt. The system became popular worldwide, and by the early 1900s, the United States also adopted the gold standard.

- Central Banking

Systems

|

| The Fed |

The Great Depression, which began in the United States in 1929 and spread worldwide, was the longest and most severe economic downturn in modern history due to deflation (decrease of the overall price level) and poor regulations of gold standardized banking system was one of the reason of it. It was characterized by significant drops in industrial production and prices (deflation), widespread unemployment, banking crises, and a notable rise in poverty and homelessness rates.

|

| The Great Depression |

To solve this problem President Franklin D. Roosevelt ended the relationship between the dollar and gold. This enabled the banks to get back the power of printing and controlling the quantity of money. And to solve another upcoming inflation caused by banks (using the power of money supply), the United States created their central banking system The Federal Reserve System (often shortened to the Federal Reserve, or the Fed).

- Fiat Money (Money We Trust)

The Fed regulated that there is neither more nor less money in the country. From then to till now mostly paper money with no intrinsic value is available, which is called Fiat Money. The government guarantees that it has value. For example, the $20 bill we use to buy something is valuable because everyone trusts it, even though it’s just paper.

- Digital Money and Cryptocurrencies

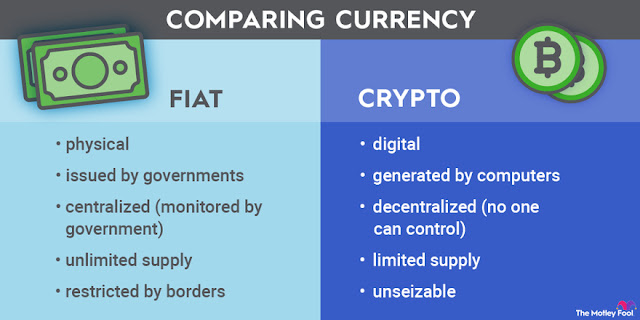

Digital money, or digital currency, is any form of money that exists only online. Unlike cash, checks, or coins, digital currency is tracked and sent using computer codes. As technology becomes more widespread, more people are using digital options for payments, which means people rely less on physical money. Using digital money is becoming easier and safer through technologies like credit cards, mobile phones, and online platforms for buying cryptocurrencies. However, online banking can have privacy concerns, such as the risk of being hacked.

Cryptocurrency is a type of digital or virtual currency that is secured by encryption and runs on a network of many computers. This decentralized setup allows cryptocurrencies to operate independently of governments and central authorities, reducing the risk of hacking or leaking user information.

|

| Image Source: The Motley Fool |

Reference

https://www.investopedia.com/articles/07/roots_of_money.asp

https://en.wikipedia.org/wiki/Lydia

https://www.britannica.com/biography/Kublai-Khan

https://www.britannica.com/event/Great-Depression

https://www.investopedia.com/terms/c/cryptocurrency.asp

https://www.analyticsinsight.net/digital-transformation/digital-money-the-future-of-payments

https://www.fool.com/terms/f/fiat-currency/

0 Comments